Principally, as self-directed investors, many SMSF investors cite the level of control and tailoring an SMSF provides them as key features and reasons they have an SMSF.

However, there are times and circumstances when leveraging the benefits of institutional investment managers and professional trustee entities can provide an additional element of diversification, support, and risk management for you.

Like many investors in recent times, whether full-time professional asset managers, sector specialists, advisers or trustees, you’ve probably spent more time lately assessing your SMSF’s investment strategy and portfolio, especially considering what has been an exceptionally challenging and uncertain investment environment.

As Australia and the world transition to a 'COVID-normal' setting, it’s timely for trustees and their advisers to actively review investment strategies and asset portfolios to ensure the investment strategy remains appropriate and able to weather ups and downs, and hopefully thrive, while remaining focussed on the strategy’s key objectives. Also, of importance, is to review the fund’s investment portfolio to ensure the assets remain appropriate and positioned to achieve your outcomes.

Today, SMSFs have a much wider array of investment opportunities and selections than ever before. However, due to their high barriers to entry, level of minimum investment and, in some cases, scarcity, some asset classes and sub-asset classes remain as hard to access and get set in as ever before, other than by significant institutional investors with the scale and experience to invest in them effectively and efficiently.

And despite these widening opportunities set for SMSF investors, many funds continue to remain heavily weighted towards traditional, retail, asset classes, such as shares, bonds and cash. Each of these asset classes has been, and remain to varying degrees, challenged by the recent investment market gyrations and macro-economic settings, which has materially reduced the so-called risk-free premium of defensive assets, such as cash, as interest rates continue to sit at unprecedented lows.

For many, including professional institutional investors, this has required the need to consider more actively allocating their investments to higher-risk assets, such as shares and managed funds, to generate returns.

A well-diversified investment strategy can play an important role in providing investors with a more stable pattern of returns, enhancing downside protection in times when there is increased volatility in investment markets and reducing the overall risk of an investment portfolio.

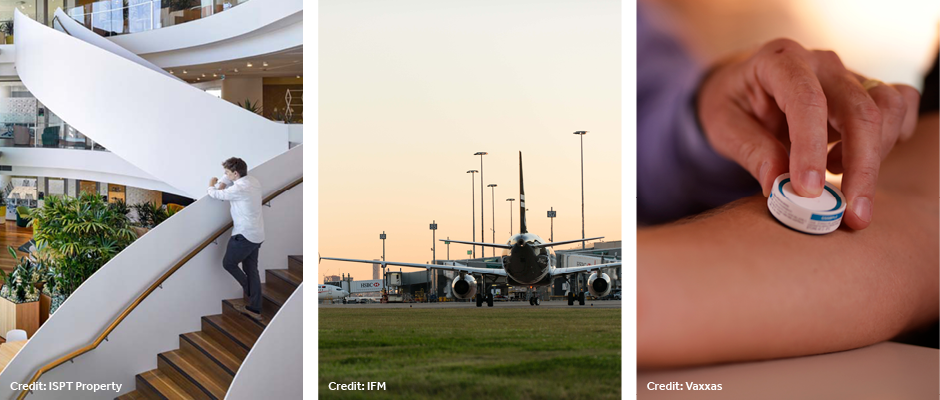

For many institutional investors, like Hostplus, the ability to invest in asset classes such as unlisted property, infrastructure and private equity can play a valuable role within a broader investment strategy by providing consistent and reliable absolute returns over the long term, with a lower correlation to listed investment markets and thereby contribute to improved risk and return outcomes over the long term.

Today, and increasingly into the future, we believe these assets will continue to deliver improved diversification, risk-adjusted returns and investment growth for SMSF investors. This extends to being able to invest through and alongside a significantly sized and experienced industry fund with quality unlisted assets spanning airports and seaports, renewable energy sources, shopping centres, convention centres, offices and industrial buildings, to name just a few.

The information in this article is correct as at the time of publication.